The facts and figures of Deaths in Road Accidents in the UK

Deaths due to road accidents are recorded centrally and provide an overarching picture of the fatalities and casualties on our roads. An important insight into fatal road accident statistics can be gained where road users are sadly killed that can be broken down by various factors such a as the mode of transport, age and sex of the victims even down to location.

Road Accident Crash Map

There is an excellent statistical tool that provides details of road accidents near you. Simple type in your post code and you will find details of accidents from minor to fatal injuries within a region where you live. Click on the picturing of the map below to take you to the website.

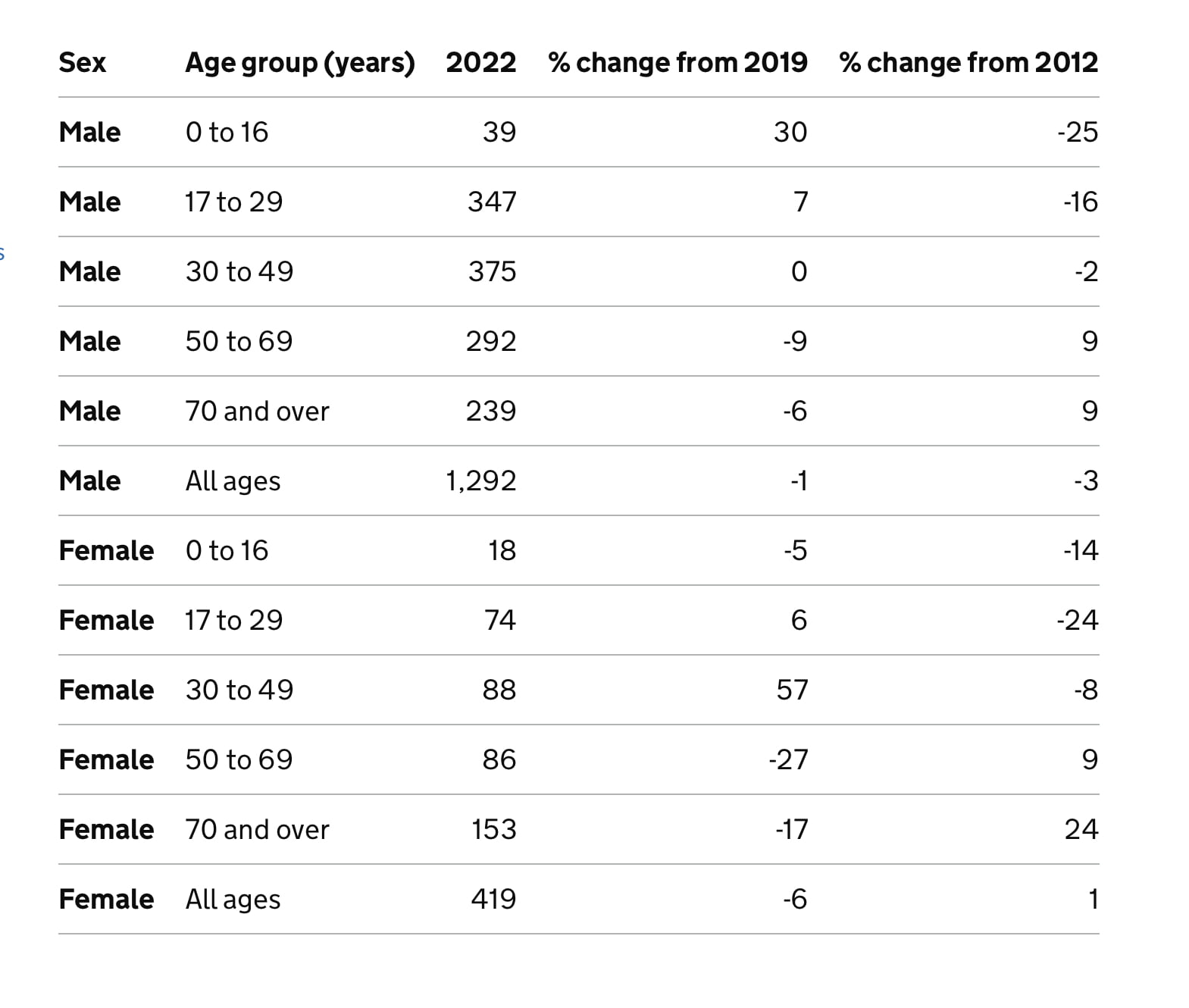

Age and Sex Data

The following fatal road accident statistics depicts fatal road accidents by Age and Sex courtesy of the Department of Transport, the information is a comparison between years 2019 and 2022 respectively.

The highest group of road deaths are male age 30 to 49 years. This mirrors the same age group for females.

The following road death statistics published by the Department of Transport in September 2023 are summarised below:

1. Deprivation: The Index of Multiple Deprivation (IMD) reveals a correlation between road deaths and deprivation, with a higher proportion of fatal road accidents occurring in more deprived areas.

2. Road Casualties: The trend in fatal road casualties over four decades, showing a general decline. In 2022, road casualties increased compared to 2020 and 2021, indicating a return to pre-pandemic trends. The final estimates for reported road collisions in Great Britain in 2022 include 1,711 fatalities (2% decline from 2019), 29,742 killed or seriously injured (3% decline), and 135,480 casualties of all severities (12% decline).

3. Casualty Rates: The casualty rates per billion miles traveled in 2022 increased slightly compared to 2019, with 5 road fatalities, 91 killed or seriously injured casualties, and 413 casualties of all severities. The data suggests stability in casualty rates over the last decade, influenced by changes in traffic patterns and the impact of COVID-19 lockdowns.

4. Not Wearing a Seatbelt: In 2022, around a fifth of car passengers were not wearing seatbelts. The proportion was higher for male car occupant fatalities and those traveling during the evening and night (6pm to 8am).

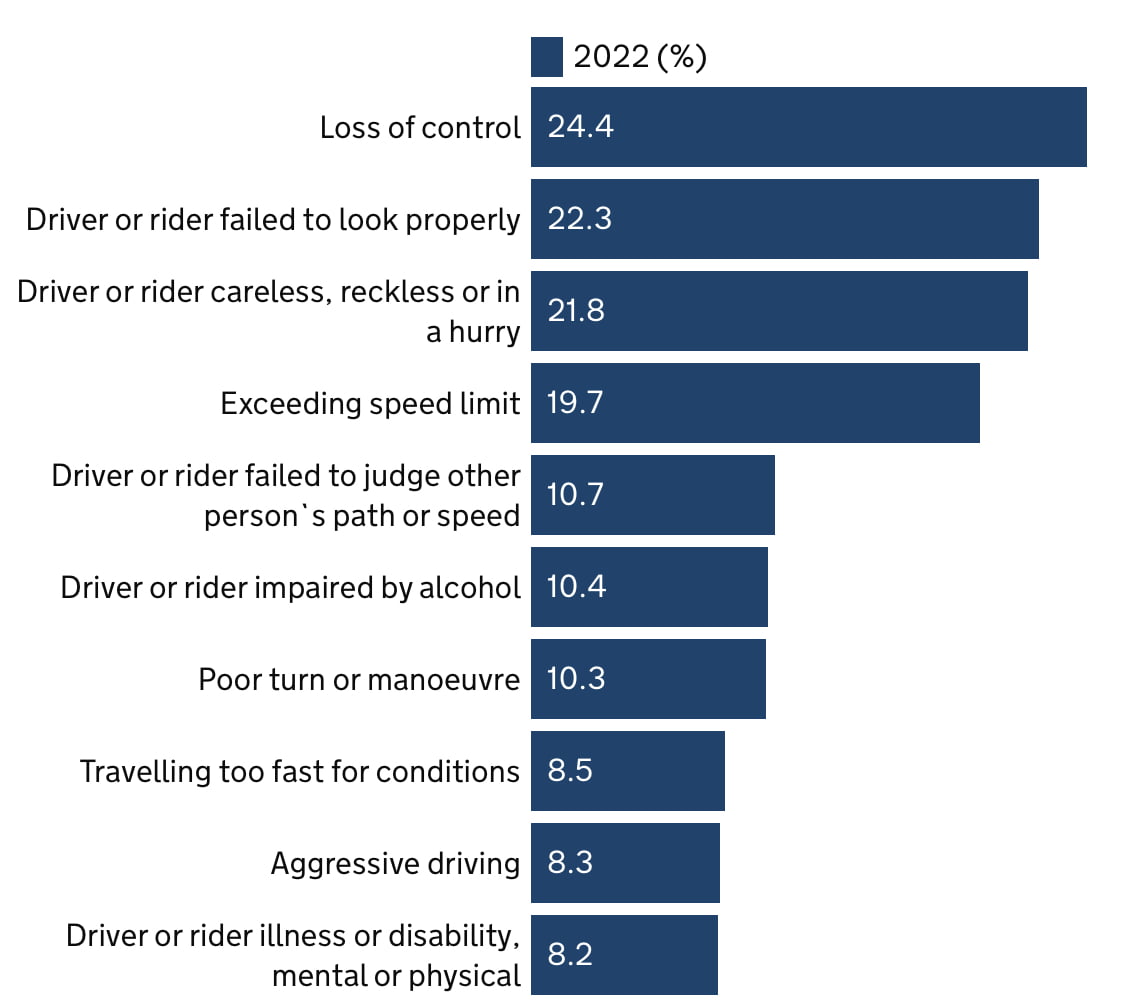

What are the most common causes of fatal road accidents?

The statistics show the following:

The man three main causes of death by road accidents are:

- Loss of control

- Driver or rider failed to look properly

- Driver or rider careless, reckless or in a hurry

The factors in relegation to where the driver or rider is careless for reckless relate to the common offences of:

Causing death by dangerous driving riding

Causing death by dangerous driving is one thing bereaved families must consider when facing an untimely and sudden loss of a loved one following a tragic road accident. A driver or cyclist charged with the offence will be liable for a civil claim for compensation and criminal charges by the police, potentially leading to imprisonment.

Causing death by careless driving or riding

Many of the deaths on UK roads are caused by fatal road accidents due to death by careless driving. If someone is arrested by the police and found guilty of causing death by careless driving, they may face time in prison. As well as imprisonment, the culprit may also be liable for a civil claim where damages will be paid to the bereaved family.

Fatal road accidents caused by drink and drugs

In 2021, estimates of casualties in collisions involving at least one driver or rider over the drink-drive limit in Great Britain revealed concerning trends:

– 240 to 280 people were killed in drink-drive collisions, with a central estimate of 260 fatalities.

– The estimate for fatalities in 2021 is the highest since 2009, indicating a statistically significant increase from 2020.

– The central estimate for killed or seriously injured drink-drive casualties in 2021 is 1,880, marking a notable 23% increase from 2020.

– An estimated 6,740 people were killed or injured in drink-drive collisions, showing a 4% rise from 2020. The impact of the COVID-19 pandemic is noted, with increases in 2021 following

reductions in the previous year.

Fatal Accidents to Cycle Riders

The Table below shows the number of cycle riders killed on UK roads per billion of miles travelled. When compared with distance traveled pedal cyclist and motorbike riders fair unfavourably due to the fact that they are vunerarble road users.

Overall personal injury rates for car occupants, pedal cyclists and motorcyclists have shown a decline in numbers.

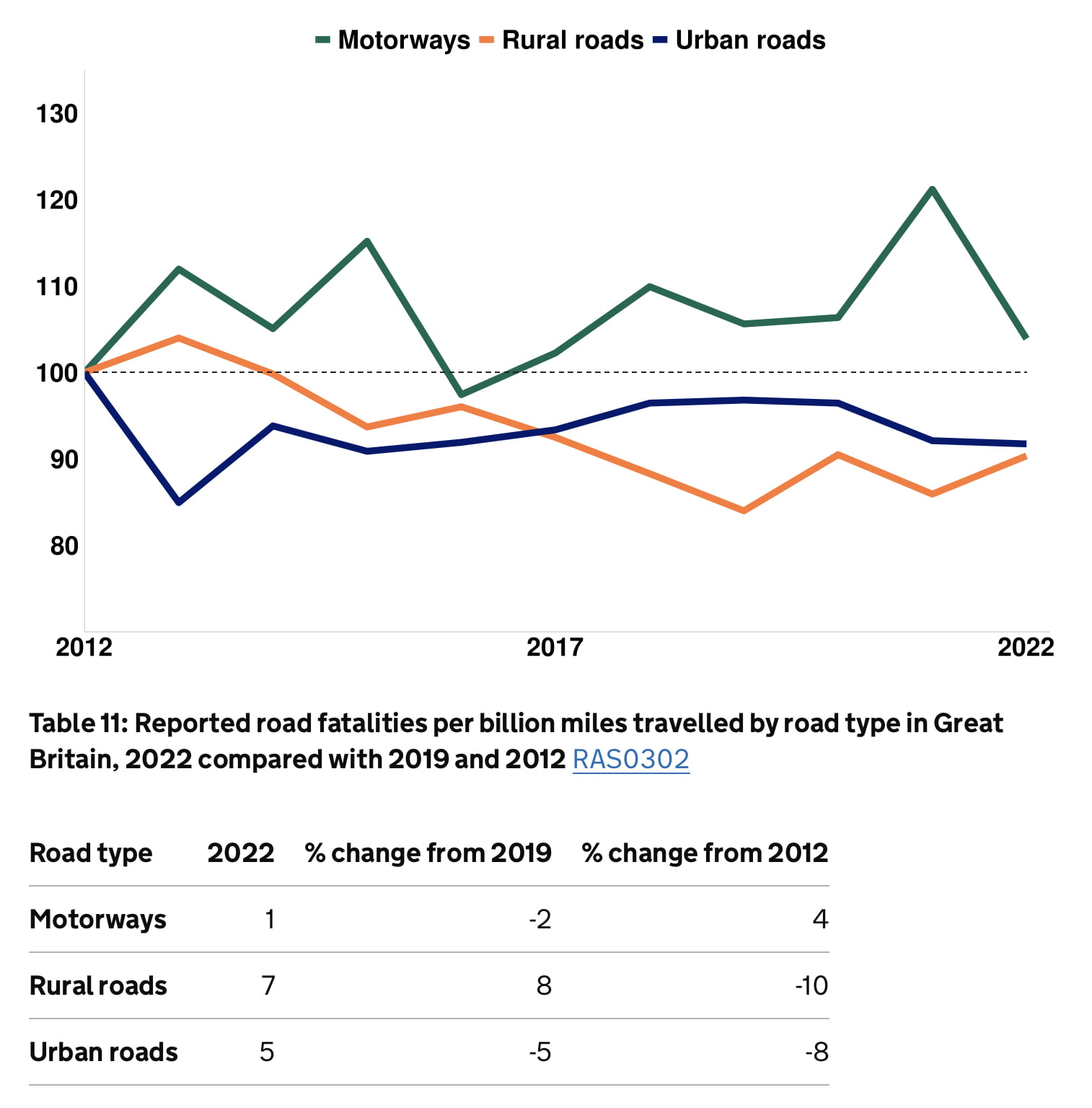

Fatal Road Accidents By Type of Road

These statistics depict the fatalities where death has occurred on a specific road type such as a motorways, urban or rural roads. In the road casualty report it provides:

In 2022, the majority of road fatalities occurred on rural roads, whereas the majority of all casualties occurred on urban roads. Although motorways account

for 21% of road traffic, they account for a much smaller proportion of road fatalities (6%) and casualties (4%). By contrast, rural road fatalities (59%) are over represented compared to the proportion of rural road traffic (44%). Similarly, urban roads account for a much higher proportion of road casualties (63%) than their relative traffic level (35%).

The statistics show:

Motorways – 100 killed

Rural roads – 1018 killed

Urban roads – 593 killed

Surprisingly particularly when talking to the older generation they are of the view that the majority of fatal accidents occur on motorways but the statistics clearly show otherwise. It is the ‘country lanes’ and roads that provide the most fatalities on UK roads.

Did you know?

Every single day of the week, 365 days of the years tragically somebody is killed or seriously injured on UK roads.

Expert fatal road accident solicitors

We are expert solicitors where we assist bereaved families when they have suffered a sudden loss of a loved one due to a fatal road accident. We act for riders of motorbikes and pedal bikes, riders of E-Scooters, car drivers and passengers and pedestrians who have all been tragically killed in England and Wales.

When a life is lost in a road accident, our approach to caring extends beyond statistical analysis. Each individual represents a unique story, a collection of experiences, dreams, and connections. Recognising the profound loss suffered by the affected family and community, we emphasise the human aspect, ensuring that the person is not merely reduced to a statistic.

We offer our very personal approach to the families claim. Our solicitor will offer their own direct line telephone number so that they can chat, text, message them without going through a switch board.

Our service extends to providing support, empathy, and understanding, acknowledging the emotional depth that comes with the tragedy. We strive to honour the memory of the person, respecting their life and the impact their absence has on those who knew them, that are our clients.

In these moments, our commitment to compassion underscores the understanding that behind every number is a life that mattered, and we stand ready to ensure every legal stone is not left unturned with our pursuit of justice and gaining maximum fatal accident compensation for the bereaved family.

If you or a family member have been affected by this article, please contact us today to make a fatal road accident claim.